Medical insurance claim forms are crucial in ensuring that healthcare providers are reimbursed for their services in healthcare industry. These forms are official documents detailing the services rendered to patients, associated costs, and the necessary patient and insurance information. Understanding different types of medical claim forms is essential for healthcare providers and patients to navigate complex medical billing world effectively.

Types of medical claims forms

Medical claims forms are used by healthcare providers to ask insurance companies for payment. Each form is made for a specific type of service to make the process simple and accurate. Here are definitions of common claims forms.

- CMS-1500 Form: A standardized form used by individual healthcare providers to bill professional services and outpatient procedures.

- UB-04 Form (CMS-1450): A form used by institutional providers, such as hospitals and nursing facilities, to bill facility-based services.

- ADA Dental Claim Form: A specialized form for dental professionals to bill procedures and treatments using dental-specific codes.

- Workers’ Compensation Claim Form: A form used to bill for medical services related to work-related injuries or illnesses.

- Pharmacy Claim Form: A form used by pharmacies to bill for medications dispensed to patients.

- Tricare Claim Form: A form used to bill for medical and dental services under the Tricare program for military personnel and their dependents.

- Vision Claim Form: A form used to bill for vision-related services such as exams and eyewear.

- Accident/Injury Claim Form: A form used to bill for medical services related to accidental injuries.

- Medicaid and Medicare Claim Forms: Forms used to bill for services provided to Medicaid and Medicare beneficiaries.

- Supplemental Insurance Claim Form: A form used to bill secondary or supplemental insurance for costs not covered by primary insurance.

Understanding Medical Claim Forms

Medical claim forms are standardized documents used to submit claims to insurance companies for payment. They contain vital information about patient, healthcare provider, services, and associated costs. Accurate and complete submission of these forms is critical, as errors can lead to claim denials, delayed payments, and additional administrative burdens.

Common Types of Medical Claim Forms

1. Professional Claim Form (CMS-1500)

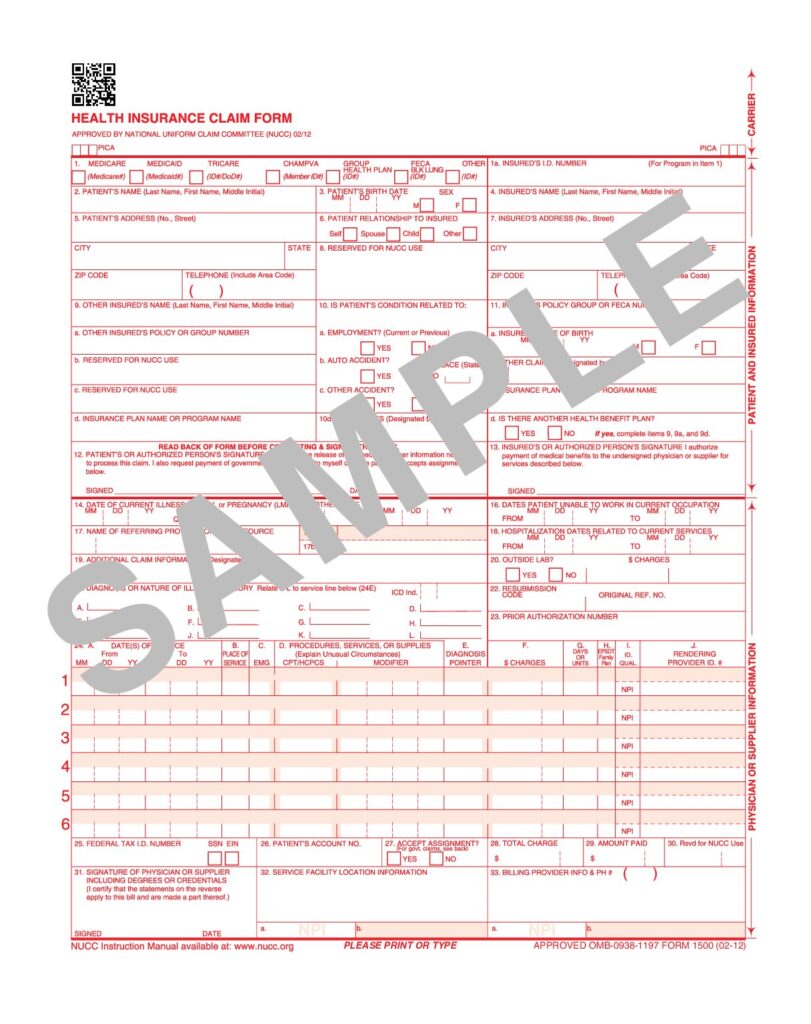

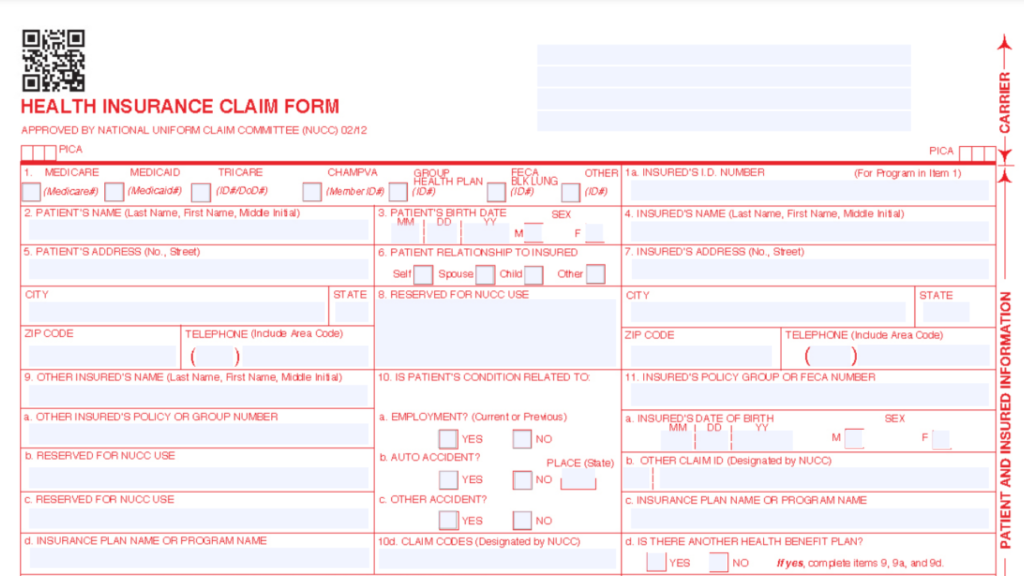

CMS-1500 form is a crucial document used primarily by individual healthcare providers, including physicians, therapists, and non institutional providers, to submit claims for reimbursement to Medicare, Medicaid, and many private insurers. Understanding key sections of this form is essential for accurate and efficient claims processing.

Key Sections of the CMS-1500 Form

1.1 Patient Information

- Demographics: This section captures vital patient details, including patient’s name, address, date of birth, and gender. Accurate demographic information ensures proper identification and processing of the claim.

- Insurance Details: Information about patient’s insurance coverage is also included here, such as policy number and name of insurance company. This section helps in verifying eligibility and benefits.

1.2 Provider Information

- Healthcare Provider Details: This section identifies healthcare provider submitting claim, including their name, address, and phone number.

- National Provider Identifier (NPI): The NPI is a unique identification number assigned to healthcare providers. It must be included to ensure proper identification and processing by insurance payer.

1.3 Service Details

- List of Services Performed: This section details medical services rendered to the patient. Each service must be accurately described using appropriate codes.

- Coding: The services are coded using either Current Procedural Terminology (CPT) codes or Healthcare Common Procedure Coding System (HCPCS) codes. These codes help convey specific procedures performed during the patient’s visit.

1.4 Diagnosis Codes

- Medical Condition Identification: This section specifies medical condition or diagnosis related to services provided. Each diagnosis must be coded using International Classification of Diseases (ICD) codes.

- Linking Diagnoses to Services: Accurate diagnosis coding is crucial as it connects patient’s condition with the services billed. This linkage is vital for justifying the necessity of provided services.

2. Institutional Claim Form (UB-04)

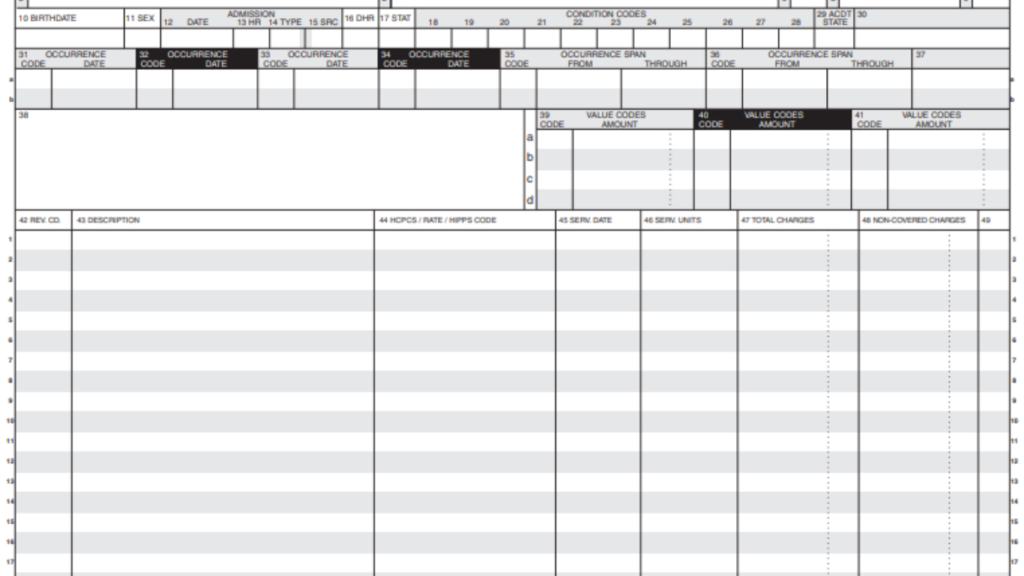

UB-04 form, also known as the CMS-1450, is a standardized claim form used by institutional providers such as hospitals, nursing homes, and outpatient facilities. This form is specifically designed to accommodate complexities of institutional billing, allowing for a comprehensive representation of the services provided to patients during their stay or visit.

Key Sections of the UB-04 Form

2.1 Patient Information

- Demographics: This section captures essential patient details, including the patient’s name, address, date of birth, and insurance information. Accurate patient demographics are vital for proper identification and processing of claims.

- Insurance Details: Information regarding patient’s insurance coverage, including policy number and name of insurance provider, is recorded here to verify eligibility and ensure that claims are directed to the appropriate payer.

2.2 Facility Information

- Institution Details: This section provides important information about the healthcare facility submitting claim, including facility’s name, address, and phone number.

- Provider Identification: The National Provider Identifier (NPI) for institution must also be included, ensuring proper identification in claims process.

2.3 Revenue Codes

- Service Representation: Revenue codes are specific numerical codes that represent different services, accommodations, and types of care provided to the patient. These codes categorize the services into groups that facilitate billing and reimbursement.

- Detailed Listing: Each revenue code corresponds to specific services rendered, such as room charges, ancillary services, and other facility related costs. This allows insurers to understand the types of care provided during patient’s stay.

2.4 Diagnosis Codes

- Medical Condition Documentation: This section specifies the patient’s diagnosis or medical condition related to the services provided. Each diagnosis is coded using the International Classification of Diseases (ICD) codes.

- Connection to Services: Accurate diagnosis coding is crucial as it links the patient’s condition to the services billed on the UB-04 form. This linkage is essential for justifying the necessity of the services rendered and for ensuring appropriate reimbursement.

3. Dental Claim Form

Dental claim forms are essential documents used to submit claims for dental services rendered to patients. The most widely recognized form is the ADA Dental Claim Form, specifically designed to capture the nuances of dental procedures and ensure accurate processing by insurance providers.

Key Information Included in Dental Claims

3.1 Patient and Provider Information

- Patient Demographics: This section includes essential details about the patient, such as their name, address, date of birth, and insurance information. Accurate patient data is crucial for identifying the individual and confirming insurance coverage.

- Provider Information: This includes the dental practice’s details, such as the dentist’s name, practice address, phone number, and National Provider Identifier (NPI). Proper identification of the provider ensures that claims are processed correctly and attributed to the right healthcare professional.

3.2 Treatment Information

- Detailed Descriptions of Services: This section outlines the specific dental procedures performed during the patient’s visit. It provides a comprehensive overview of the treatments administered, such as examinations, cleanings, fillings, and other dental services.

- Additional Notes: If necessary, this area can include any pertinent notes about the patient’s condition or the necessity of the treatments provided, which may assist in justifying the claims submitted to the insurance provider.

3.3 Procedure Codes

- Specific Coding for Services Rendered: Each dental procedure is assigned a unique code from the American Dental Association (ADA) code set. These codes indicate the specific services rendered during the patient’s visit, ensuring clear communication between providers and insurers.

- Linking Procedures to Benefits: Accurate coding is essential for determining the benefits that the patient’s insurance will cover. It allows insurers to assess the validity of the claim and process payments appropriately.

4 Workers Compensation Claim Forms

Workers compensation claim forms are specialized documents to submit claims related to work related injuries or illnesses. These forms are critical in securing benefits for injured employees while performing their duties. They are submitted to the workers’ compensation insurance provider to ensure that employees receive appropriate medical care and compensation for lost wages.

Key Aspects of Workers’ Compensation Claim Forms

4.1 Employer Information

- Details about the Employer: This section includes important information about the employer, such as the company’s name, address, and contact information. Accurate employer details help verify the legitimacy of the claim.

- Policy Number: The workers’ compensation insurance policy number must also be provided. This identifier is crucial for the insurance provider to access the specific coverage details relevant to the claim.

4.2 Employee Information

- Demographics: This section captures essential details about the injured employee, including their name, address, date of birth, and Social Security number. Accurate demographic information is vital for proper identification and processing of the claim.

- Incident Details: This part includes a description of the incident that led to the injury, including the date, time, and location. Clear documentation of the incident helps establishes the claim’s context and the circumstances surrounding the injury.

4.3 Injury Details

- Description of the Injury: This section provides a comprehensive description of the employee’s injury, including the nature of the injury (e.g., fracture, sprain) and any affected body parts. Detailed information helps insurers assess the claim’s validity and necessity for medical treatment.

- Medical Services Provided: This part outlines the medical services that the employee received due to the injury, including hospital visits, treatments, and rehabilitation services. Documenting the medical care received is essential for determining the benefits that should be covered under the workers compensation policy.

5. Coordination of Benefits (COB) Forms

Coordination of Benefits (COB) forms are essential documents for a patient with multiple insurance coverages. These forms help healthcare providers and insurers determine order in which multiple insurance policies will pay for the patient’s medical expenses. The primary purpose of a COB form is to ensure that patient receives appropriate coverage without exceeding total cost of care.

Overview of COB Forms

5.1 Insurance Information

Details About All Policies: This section captures comprehensive information regarding all insurance policies covering the patient. It typically includes:

- Names of the insurance companies.

- Policy numbers for each coverage.

- Coverage start and end dates.

- Information about whether the policy is an employer sponsored plan, individual plan, or government program.

Verification of Benefits: Collecting detailed insurance information is crucial for verifying coverage and benefits available to patient and identifying the terms of each policy.

5.2 Payment Responsibility

Clarification of Primary and Secondary Insurance: This section outlines payment responsibility for each insurance policy:

- Primary Insurance: The insurance plan that pays first, covering expenses according to its benefits.

- Secondary Insurance: The plan that pays after primary insurance, covering any remaining costs as per its coverage terms.

Determining Payment Order: The COB form helps to establish order of payment, ensuring that total payments from both insurers do not exceed total cost of care. This process prevents overpayment and ensures compliance with insurance regulations.

6. Specialized Medical Claim Forms

6.1 Medicare Claim Forms

Medicare claims have specific requirements, often using CMS-1500 or UB-04 forms, depending on the provider type. Claims must comply with Medicare guidelines to ensure proper reimbursement.

6.2 Medicaid Claim Forms

Depending on the provider type, Medicare claims have specific requirements, often using CMS-1500 or UB-04 forms. Claims must comply with Medicare guidelines to ensure proper reimbursement.

Filling out these forms correctly is essential to avoid common reasons for insurance denials, such as missing or incorrect information. To understand the key reasons why claims get denied and how to prevent them, check out our blog on Reasons for Insurance Denials.

Importance of Accurate Claim Form Submission

Accurate submission of medical claim forms is crucial in billing process. Common reasons for claim denials include incomplete forms, incorrect coding, and missing information. These denials can significantly delay reimbursement, impacting healthcare providers’ cash flow and administrative workload.

Tips for Completing Medical Claim Forms

To ensure accurate and complete submissions, healthcare providers should follow these best practices:

- Double check all patient and provider information.

- Use correct codes for services and diagnoses.

- Ensure all required fields are completed.

- Keep up to date with changes in billing regulations and requirements.

- Utilize software solutions designed for medical billing to minimize errors.

Conclusion

Understanding the different types of medical claim forms is essential for healthcare providers and patients. Providers can streamline billing process, reduce claim denials, and facilitate timely reimbursements by ensuring accurate submissions. Proper education on these forms can lead to a more efficient healthcare billing environment.